This post will recap this weeks weekly treatise meeting. As mentioned last week my weekly deliverable was to provide some preliminary results of Allen Partial Elasticity of Substitution (AES) measure. I will now briefly describe the process that I undertook to do this. Model Construction and Data

The data to be used provided by Dr. Poon was a cross-sectional data set. This means that we had observations for a number of variables across time. The independent variables observed over 1985 to 2002 are:

- SK: Software Capital

- HK: Hardware Capital (includes computer and peripheral but machinery and other electrical equipment)

- OK: Organisation Capital (Difference between Capital Stock and Software Capital and Hardware Capital)

- LH: Labour Hours

- VA: Value Added

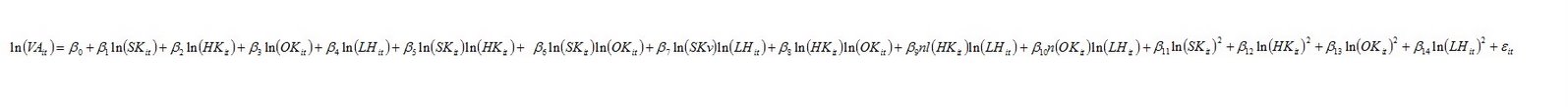

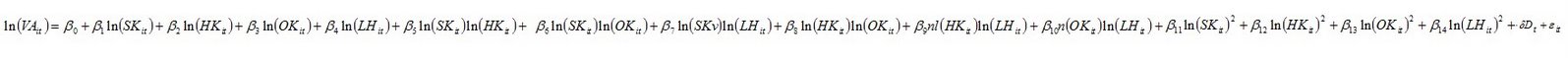

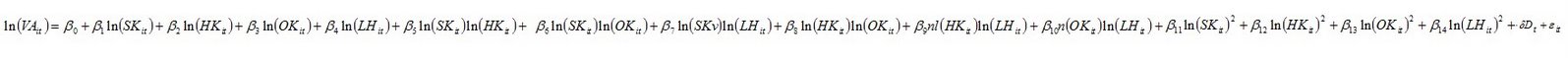

The productivity function that I applied is the translog-production function similar to Hitt (2002), model (1). Click on the image to enlarge and view the equation.

The choice for this model was that it does not constrain the elasticities to be unary.

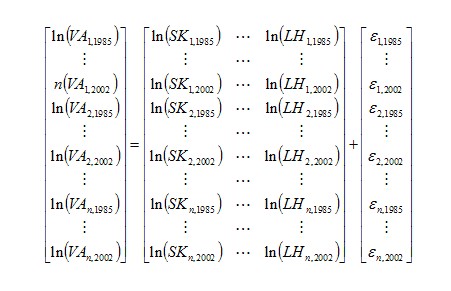

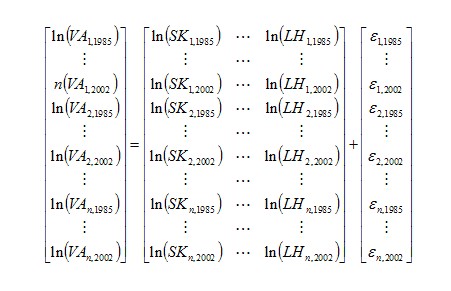

Since I am assuming that the model is a Classical Linear Regression Model (CLRM) and applying Ordinary Least Squares (OLS) to estimate the parameters of the model I need to stack the data in such a way that OLS could be applied. To achieve this I stacked the data over time for each industry as per below.

I then transformed the data to be in accordance with the model (1) and a pooled OLS was then run in R to find the coefficients. The results of the regression are below: Call:

lm(formula = lnVa ~ lnSk + lnHk + lnOk + lnLh + lnSklnHk + lnSklnOk + lnSklnLh + lnHklnOk + lnHklnLh + lnOklnLh + lnSk2 + lnHk2 + lnOk2 + lnLh2)

Residuals:

Min 1Q Median 3Q Max

-0.58722 -0.16982 -0.02798 0.19408 0.72151

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 8.493241 6.164181 1.378 0.16979

lnSk -7.735495 1.051449 -7.357 4.69e-12 ***

lnHk 4.858182 0.820692 5.920 1.37e-08 ***

lnOk -3.002444 0.727414 -4.128 5.37e-05 ***

lnLh 4.214768 1.148203 3.671 0.00031 ***

lnSklnHk -0.008317 0.093900 -0.089 0.92951

lnSklnOk 0.586699 0.088497 6.630 3.03e-10 ***

lnSklnLh 0.064016 0.058670 1.091 0.27652

lnHklnOk -0.390088 0.063354 -6.157 3.96e-09 ***

lnHklnLh -0.032604 0.044211 -0.737 0.46171

lnOklnLh -0.416532 0.053405 -7.799 3.31e-13 ***

lnSk2 0.067969 0.054974 1.236 0.21775

lnHk2 -0.018647 0.042730 -0.436 0.66303

lnOk2 0.290936 0.044207 6.581 3.97e-10 ***

lnLh2 0.032540 0.039548 0.823 0.41159

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.2555 on 201 degrees of freedom

Multiple R-Squared: 0.8219, Adjusted R-squared: 0.8095

F-statistic: 66.26 on 14 and 201 DF, p-value: <>

It is evident that some of the results are in contradiction to the underlying economic theory but this can be owing to the quality of the data (more about this later).

Calculation of AES

To calculate the AES I needed four items:

- Averages of the independent of variables for each industry

- Partial first order derivatives, second order derivatives of the model(1)

- Bordered Hessian matrix for each industry

- Appropriate co-factor between the independent variables for each industry

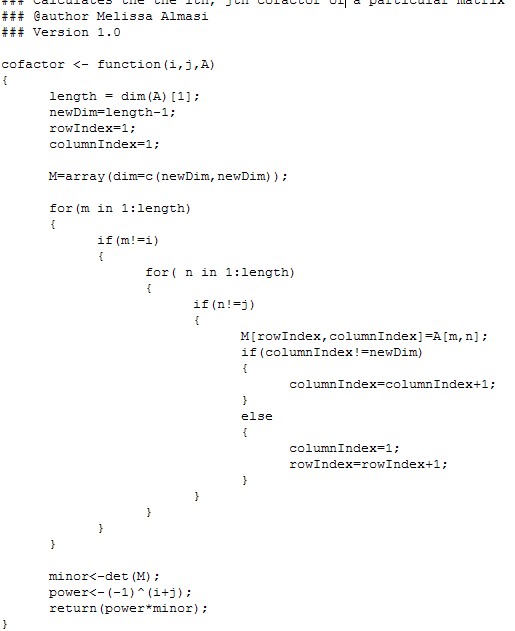

As mentioned in my early post on Monday I used maxima to calculate this, which was slightly tedious as I needed re-run these calculations for each industry. However before our meeting on Wednesday Gary (another student that Dr. Poon is supervising) found an R package called micEcon. This package can calculate a translog-production function given variables in an unaltered form and the bordered Hessian matrix. This discovery greatly will reduce the time in calculating the AES for each industry as well as the coefficients of the model. Dr. Poon has suggested that I use excel in conjunction with R to calculate the AES. I will use R to calculate the bordered Hessian matrix and co-factor matrices for each industry, determine the averages of the independent variables fore ach industry and estimate the translog-production function. Excel will then be used to calculate the AES model using the date obtained from R. Maxima can still be used in trying to find a way to simplify the equations of the partial derivative similar to the equations presented in the Appendix of Dewan and Min (1997).

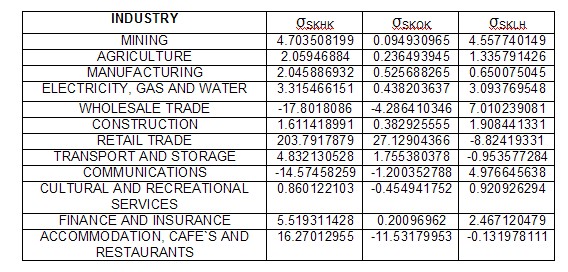

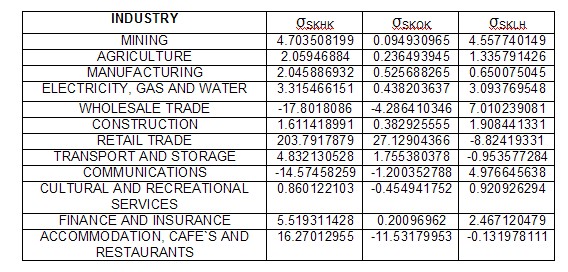

Below are the results of the partial AES between SK and the other independent variables for each industry. As mentioned earlier these are not highly accurate due to the problems with the underlying data. They are included to show that the calculation methodology employed is sound.

Next Weeks Deliverables

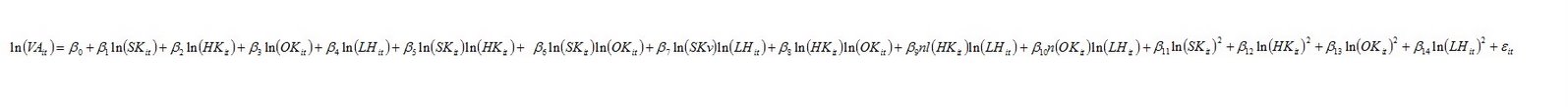

As I have mentioned throughout my post the results did contradict economic theory. Dr. Poon has suggests two things. Firstly, that I rerun my model to include a time effect variable which corresponds to every 5 years. The model will now become:

Secondly, that I worry about the results of the data later and that I should now concentrate on polishing up my calculation methodology to ensure that my procedures are correct and accurate. Dr.Poon has informed me that in my final treatise I will require a detailed description of the process that I undertook in these calculations. Furthermore Dr.Poon has also provided us with more details on the overall structure of our treatise. Since our partial treatise write up is due on August 31 Dr.Poon hopes that we will be able to complete, the Introduction & Motivation, Literature Review and Data set construction technique by then. Once I have finalised my calculation process I will publish it on the blog.