The code that I wrote to perform the aggregation tests is quite simple and is provided below.

*Read in the Data

SAMPLE 1 216

READ(AggregationData89_06.txt) Sector KH KS K1 K KSITP KSP KHP K0 L VA / SKIPLINES=1

*Transform Variables

GENR KSP = LOG(KSP)

GENR KHP = LOG(KHP)

GENR KSITP = LOG(KSITP)

GENR VA=LOG(VA)

GENR L=LOG(L)

GENR K=LOG(K)

GENR K1=LOG(K1)

GENR K0=LOG(K0)

GENR KS=LOG(KS)

GENR KH=LOG(KH)

*Create time effect dummies

MATRIX TDUM=SEAS(216,18)

DO #=1,18

GENR C#=TDUM:#

ENDO

* Run OLS for first aggregation test

OLS VA L K KSP KHP Sector C2-C18

*Perform the t-tests for the implied values

TEST

TEST K/KSP

END

TEST

TEST K/KHP

END

* Run OLS for the second aggregation test

OLS VA L K0 KSITP K1 Sector C2-C18

*Perform t-test for the implied value

TEST

TEST K1/KSITP

END

STOP

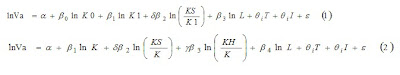

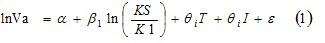

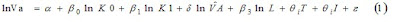

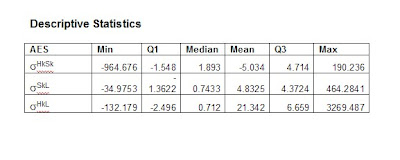

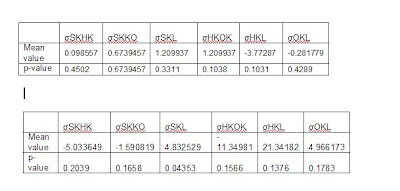

As is evident in the code above I had run the OLS by also using the natural log of the mix functions KSP (KS/K), KHP (KH/K) and KSITP (KS/K1). However, this provided an unexpected result in the first aggregation test with the p-value of the mix function KSP to be around 0.70 which means that since we cannot reject the null hypothesis from KSP being statistically different from zero this implies that KS (Software capital) can be aggregated into ordinary capital. I have passed on these results to Dr. Poon who has asked me to re-run the tests without taking the natural logs of these mix functions. The results now show that Software Capital (KS) and Hardware Capital (KH) cannot be aggregated with non-IT capital since the p-values of the mix functions KSP, KHP are less than 0.05. Likewise the second aggregation test results show that KS and KH cannot be aggregated into a single IT capital measure (K1) since the mix function KSITP has a p-value less than 0.01. The full results are posted below.

Test for aggregation of KS into K

TEST VALUE = 0.25394E-01 STD. ERROR OF TEST VALUE 0.12112E-01

T STATISTIC = 2.0966614 WITH 193 D.F. P-VALUE= 0.03733

F STATISTIC = 4.3959891 WITH 1 AND 193 D.F. P-VALUE= 0.03733

WALD CHI-SQUARE STATISTIC = 4.3959891 WITH 1 D.F. P-VALUE= 0.03602

Test for aggregation of KH into K

TEST VALUE = 0.78809E-02 STD. ERROR OF TEST VALUE 0.33973E-02 T STATISTIC = 2.3197322 WITH 193 D.F. P-VALUE= 0.02140

F STATISTIC = 5.3811575 WITH 1 AND 193 D.F. P-VALUE= 0.02140

WALD CHI-SQUARE STATISTIC = 5.3811575 WITH 1 D.F. P-VALUE= 0.02036

Test for aggregation of KS into K1

TEST VALUE = -0.18831 STD. ERROR OF TEST VALUE 0.23904E-01

T STATISTIC = -7.8779472 WITH 193 D.F. P-VALUE= 0.00000

F STATISTIC = 62.062051 WITH 1 AND 193 D.F. P-VALUE= 0.00000

WALD CHI-SQUARE STATISTIC = 62.062051 WITH 1 D.F. P-VALUE= 0.00000